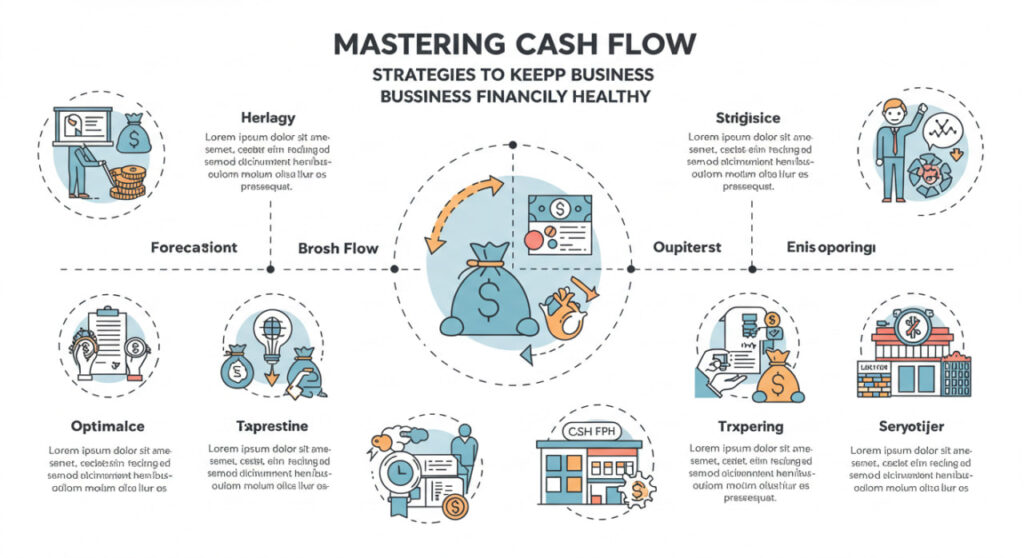

Cash flow is the lifeblood of any business, acting as the fuel that keeps operations running smoothly. Without a steady and well-managed cash flow, even the most promising ventures can falter. For small business owners, entrepreneurs, and startups, mastering cash flow is not just a financial task—it’s a strategic necessity. In this article, we’ll explore proven strategies to optimize cash flow, ensure financial stability, and position your business for long-term success. Whether you’re a seasoned entrepreneur or just starting out, these actionable insights will help you navigate the complexities of cash flow management with confidence.

Why Cash Flow Management Matters

The Foundation of Financial Health

Cash flow represents the movement of money in and out of your business—think of it as the rhythm of your company’s financial heartbeat. Positive cash flow means more money is coming in than going out, allowing you to cover expenses, invest in growth, and weather unexpected challenges. Conversely, negative cash flow can lead to missed payments, strained vendor relationships, and even bankruptcy. According to a 2023 study by the U.S. Small Business Administration, 82% of small business failures are attributed to poor cash flow management. Mastering this aspect of your business isn’t just about survival—it’s about creating a foundation for sustainable growth.

The Impact on Decision-Making

Effective cash flow management empowers you to make informed decisions. With a clear understanding of your financial inflows and outflows, you can strategically plan for investments, hiring, or expansion without overextending your resources. It also provides a buffer against economic downturns or unexpected expenses, such as equipment repairs or legal fees. By prioritizing cash flow, you gain the flexibility to seize opportunities, like launching a new product line or negotiating better terms with suppliers, without the constant fear of running dry.

Strategies to Optimize Cash Flow

Monitor Cash Flow Regularly

Use Cash Flow Statements

A cash flow statement is your roadmap to financial clarity. This document tracks the cash entering and leaving your business over a specific period, typically monthly or quarterly. Break it down into three categories: operating activities (day-to-day business transactions), investing activities (purchases or sales of assets), and financing activities (loans or equity investments). By reviewing your cash flow statement regularly, you can identify patterns, spot potential shortfalls, and make proactive adjustments. Tools like QuickBooks or Xero can automate this process, providing real-time insights that save you time and reduce errors.

Leverage Forecasting Tools

Cash flow forecasting is like a weather report for your finances—it helps you prepare for what’s coming. Use historical data and market trends to predict future cash inflows and outflows. For example, if you run a retail business, you might anticipate higher cash inflows during the holiday season. Forecasting tools, such as Float or Pulse, allow you to model different scenarios, like a delayed client payment or an unexpected expense, so you can plan accordingly. Regular forecasting keeps you ahead of the curve, ensuring you’re never caught off guard.

Accelerate Cash Inflows

Invoice Promptly and Follow Up

Delayed payments from clients can cripple your cash flow. To avoid this, issue invoices immediately after delivering goods or services. Use clear, professional invoices that specify payment terms, such as “due within 15 days,” and offer multiple payment options, like bank transfers, credit cards, or digital wallets. Follow up politely but firmly on overdue invoices—consider automating reminders through tools like FreshBooks or Zoho Invoice. Offering early payment discounts, such as 2% off for payments within 10 days, can also incentivize clients to settle their bills faster.

Diversify Revenue Streams

Relying on a single client or product for the bulk of your revenue is a recipe for cash flow instability. Diversifying your income sources can provide a safety net. For example, if you run a graphic design agency, consider offering workshops, subscription-based services, or digital products like templates alongside your core offerings. This approach not only stabilizes cash flow but also opens new growth opportunities. In 2024, businesses with multiple revenue streams reported 30% higher resilience to market fluctuations, according to a report by Deloitte.

Control Cash Outflows

Negotiate with Suppliers

Your suppliers play a critical role in your cash flow equation. Negotiate longer payment terms—say, 60 days instead of 30—to give yourself more breathing room. Alternatively, ask for bulk purchase discounts or explore consignment arrangements, where you only pay for inventory once it’s sold. Building strong relationships with suppliers can also lead to flexible terms during tough times. For instance, a small retailer might negotiate to pay for inventory in installments during a slow season, preserving cash for other critical expenses.

Cut Unnecessary Expenses

Conduct a thorough audit of your expenses to identify areas for cost savings. Look for subscriptions, utilities, or services that aren’t delivering value. For example, switching to energy-efficient equipment can reduce utility bills, while renegotiating contracts with service providers can lower operational costs. Avoid slashing essential expenses, like marketing or employee training, as these investments drive long-term growth. Instead, focus on eliminating waste, such as unused software licenses or excessive office supplies.

Build a Cash Reserve

Create an Emergency Fund

A cash reserve acts as a financial cushion, protecting your business from unexpected disruptions like economic downturns or supply chain issues. Aim to set aside enough to cover at least three to six months of operating expenses. Start small by allocating a percentage of monthly profits to a dedicated savings account. For instance, a freelance consultant earning $5,000 monthly could save 10% ($500) each month, building a $6,000 reserve in a year. This fund provides peace of mind and prevents you from relying on costly loans during emergencies.

Secure a Line of Credit

Even with a cash reserve, a business line of credit can serve as an additional safety net. Unlike a traditional loan, a line of credit allows you to borrow only what you need, when you need it, and pay interest only on the borrowed amount. Shop around for competitive rates and flexible terms—online lenders like Kabbage or traditional banks like Chase offer options tailored to small businesses. Use this credit sparingly, such as to bridge a temporary cash flow gap, and avoid relying on it for routine expenses.

Technology to Streamline Cash Flow Management

Accounting Software

Modern accounting software is a game-changer for cash flow management. Platforms like Wave, QuickBooks, or Xero offer features like automated invoicing, expense tracking, and real-time cash flow reports. These tools integrate with your bank accounts, providing a clear picture of your financial health at a glance. For example, QuickBooks’ cash flow dashboard highlights upcoming bills and expected payments, helping you stay on top of your obligations. Investing in the right software saves time and reduces the risk of human error.

Payment Processing Tools

Speeding up payments is easier with the right technology. Payment processors like Stripe or PayPal allow you to accept credit cards, digital wallets, and even cryptocurrency, catering to a wide range of customer preferences. These platforms also offer features like recurring billing for subscription-based businesses, ensuring steady cash inflows. For small businesses, the fees associated with these services (typically 2-3% per transaction) are often outweighed by the benefits of faster payments and improved customer satisfaction.

Common Cash Flow Pitfalls to Avoid

Overestimating Revenue

It’s easy to be optimistic about future sales, but overestimating revenue can lead to cash flow shortages. Base your projections on realistic data, such as past performance and current market conditions, rather than best-case scenarios. For example, a restaurant owner might assume a 20% sales increase during the summer but should account for variables like weather or competition. Conservative forecasting helps you avoid overcommitting to expenses you can’t cover.

Ignoring Seasonal Fluctuations

Many businesses experience seasonal ebbs and flows. Retailers, for instance, often see a surge in cash flow during the holidays but face lean months in early spring. Plan for these fluctuations by building a cash reserve during peak seasons and adjusting expenses during slower periods. A landscaping company, for example, might reduce marketing spend in winter while focusing on equipment maintenance to prepare for spring demand.

FAQ

What is the difference between cash flow and profit?

Profit is the revenue left after subtracting all expenses, while cash flow tracks the actual movement of money in and out of your business. A business can be profitable on paper but still face cash flow issues if payments are delayed or expenses are paid upfront.

How often should I review my cash flow?

Review your cash flow at least monthly, though weekly reviews are ideal for businesses with tight margins or seasonal fluctuations. Regular monitoring helps you catch issues early and make timely adjustments.

Can I manage cash flow without accounting software?

Yes, but it’s more time-consuming and prone to errors. Spreadsheets can work for very small businesses, but accounting software like QuickBooks or Wave automates tasks and provides real-time insights, making management more efficient.

How much cash reserve should my business have?

Aim for three to six months’ worth of operating expenses. The exact amount depends on your industry, business size, and risk tolerance. Start by saving a small percentage of profits each month and gradually build your reserve.

What are the best tools for cash flow forecasting?

Tools like Float, Pulse, or the forecasting features in QuickBooks and Xero are excellent for small businesses. They allow you to model different scenarios and predict cash flow based on historical data and market trends.

By implementing these strategies and leveraging the right tools, you can master cash flow and keep your business financially healthy. Consistent monitoring, proactive planning, and a focus on both inflows and outflows will ensure your business thrives, no matter the challenges ahead.